WG Large-scale Plant Engineering - Status Report 2024/2025

Large-scale Plant Engineering - Key to global transformation

AG Großanlagenbau - Lagebericht 2024/25 Office Video

Business development

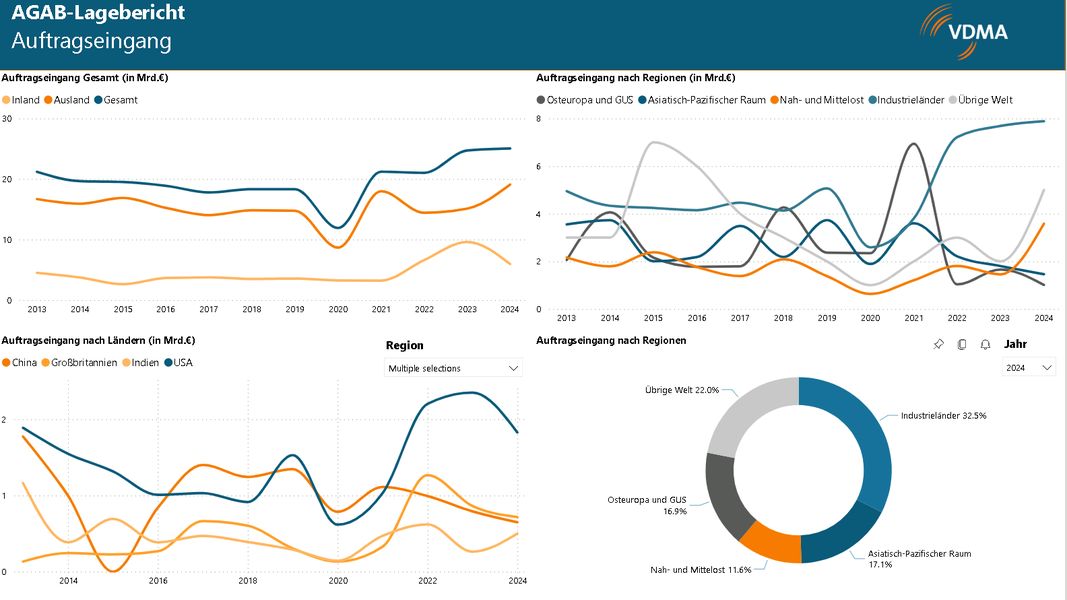

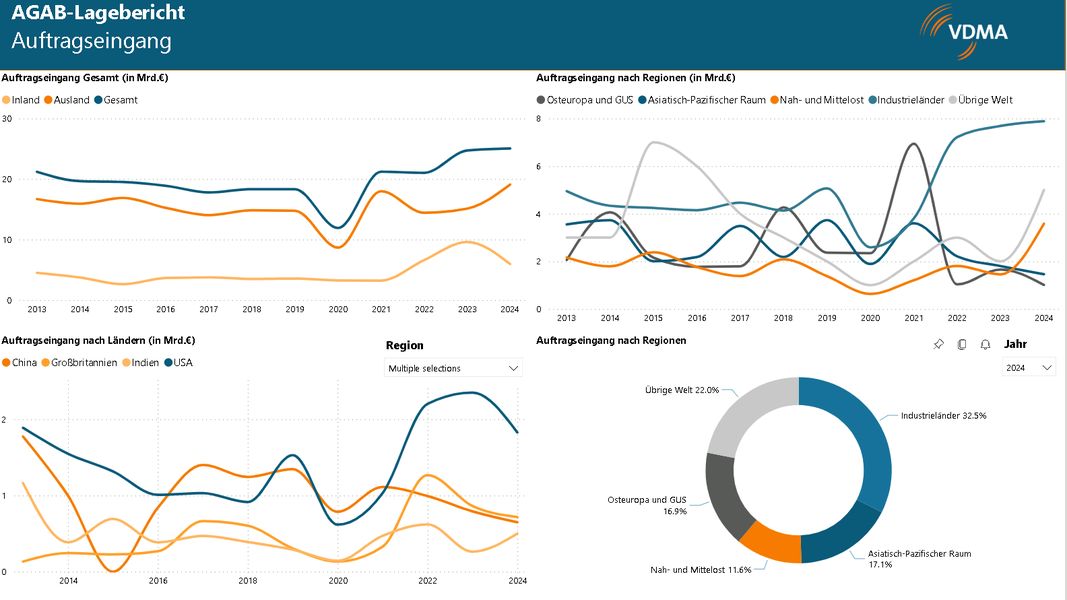

Against the backdrop of geopolitical tensions and increasing trade conflicts, the VDMA Large-scale Plant Engineering successfully held its own in the market in 2024. At 25.0 billion euros, the order intake recorded by the members of the VDMA Large-scale Plant Engineering (AGAB) in Germany and Austria was nominally 1.4 per cent above the previous year's level (2023: 24.7 billion euros). This is the highest order value since the record year of 2008 (32.8 billion euros). This growth was triggered by numerous large-scale and mega projects, most of which were ordered by customers from the energy sector and the metallurgical and chemical industries.

In addition to the use of innovative technologies in the planning and execution of projects, the companies' strategic focus on new markets and sustainable products and solutions contributed to this increase. The service business also plays an important role, as it not only contributes to long-term customer loyalty, but also represents a stable source of revenue and sustainably strengthens the overall result.

After a record year: orders from Germany normalize

In 2024, orders from Germany reached 6.0 billion euros. In relation to the record result of the previous year (2023: 9.6 billion euros), this corresponds to a decline of 38 per cent. If the average order intake of the past decade is used as a benchmark (2015 to 2024: 4.6 billion euros) - a sensible approach in the volatile business with large-scale systems, which adjusts for project-related fluctuations - this results in growth of 31 per cent. This shows that the business in Germany remains on a solid footing. Market activities in the past year focused primarily on the sustainable restructuring of the energy system and energy-intensive industries. Accordingly, the focus was on systems for CO2-free energy generation and steel production as well as systems for the transmission and distribution of energy. These sectors stood for around 85 per cent of orders from Germany in 2024, including several mega orders with a volume of over 500 million euros. One of these flagship projects is the construction of a direct reduction plant and a steelwork in Dillingen, with which the customer intends to replace the existing blast furnace route and reduce CO2 emissions by 4.8 million tons per year within six years. Another project is the construction of a new converter system for the grid connection of an offshore wind farm in the North Sea. The contract was awarded to a member of AGAB, which is responsible for all engineering services, the procurement of components and the construction, transport and installation of the systems. Growth was also recorded in chemical plant engineering in 2024: Orders rose by 44 per cent to 363 million euros (2023: 253 million euros). Particularly noteworthy are several major projects in the gas generation segment, including a 100-megawatt plant for renewable hydrogen, which is being built at the Wesseling Chemical Park. In other sectors, such as plant construction for the wood, paper and cement industries, no major projects were realized in Germany in 2024.

Charts on incoming ordersTIPP

Incoming orders provide important information on the current situation in large-scale plant engineering. They provide insights into country-specific and regional trends and serve as an indicator for future economic developments. The market figures presented here are based on primary surveys of the members of the Large Industrial Plant Manufacturers' Association and provide reliable information on the actual business development of the industry. To view the charts, please click on the headline.

Charts on salesTIPP

Turnover in large-scale plant construction is developing continuously. One reason for this is the payment methods. Customers often transfer their installments in line with the construction progress of a plant, which leads to a constant flow of income. On the other hand, the expansion of the service business is stabilizing the inflow of funds. Nevertheless, turnover in large-scale plant construction is less suitable as an indicator for assessing market development, as it reflects past orders due to the long-term nature of the projects. To view the charts, please click on the headline.

Environment and trends in large-scale plant engineering

Global economic environment

The International Monetary Fund (IMF) is forecasting real global Gross domestic product growth of 3.3 per cent in both 2025 and 2026 (2024: 3.2 per cent). These figures are below the long-term average of 3.8 per cent (2000 to 2019) and indicate subdued economic momentum.

Ongoing geopolitical tensions, in particular the war in Ukraine, and the protectionist course of the new US administration are weighing on the global economy and increasing general uncertainty. In addition, many countries are facing structural challenges such as demographic change, technological upheaval, cyber risks and - particularly in the EU - a high level of regulation, which is hampering economic activity. Rising energy and commodity prices are also fueling inflation.

In most emerging and developing countries, the conditions for economic growth are more favorable. Gross domestic product is expected to grow by 4.2 per cent in 2025, with India (6.5 per cent) and China (4.6 per cent) likely to record the highest rates. These countries are benefiting from a young population, rising investment in infrastructure and digitalization and increasing industrialization.

Political positions

The project business of VDMA Large-scale Plant Engineering has always depended on a reliable political framework. In view of the dynamics of current geopolitics and trade policy, VDMA Large-scale Plant Engineering supports the goal of focussing on expanding competitiveness both nationally and within the EU, including with the Clean Industrial Deal. The ‘omnibus’ to postpone and ease obligations within the framework of the EU taxonomy, CSRD, CSDDD and CBAM is a first step in the right direction. However, if we want to deepen the EU internal market, many bureaucratic hurdles that have grown over the years must also be significantly reduced, such as the completely inconsistent reporting obligations for intra-European labour assignments.

However, policymakers should also utilise the opportunities offered by export financing instruments in conjunction with state export credit guarantees. This instrument can be used to provide financing for projects in emerging and developing countries in particular. These countries should also benefit from transformation projects, despite the great need for financing in Europe. For large-scale plant engineering, it is about the possibility of being involved in such projects in various constellations. The basis for this is being able to offer competitive services. Against this backdrop, the large-scale plant engineering sector welcomes the modernisation of the OECD Arrangement on Export Credit Guarantees and the latest package of measures in Germany to strengthen Euler Hermes cover is also on the right track. However, practical implementation is only slowly getting underway and other export credit agencies, such as those in Denmark, Switzerland and Austria, continue to offer their exporting companies far more flexibility. Progress is urgently needed in linking development co-operation funds and export credit insurance.

However, policymakers should also utilise the opportunities offered by export financing instruments in conjunction with state export credit guarantees. This instrument can be used to provide financing for projects in emerging and developing countries in particular. These countries should also benefit from transformation projects, despite the great need for financing in Europe. For large-scale plant engineering, it is about the possibility of being involved in such projects in various constellations. The basis for this is being able to offer competitive services. Against this backdrop, the large-scale plant engineering sector welcomes the modernisation of the OECD Arrangement on Export Credit Guarantees and the latest package of measures in Germany to strengthen Euler Hermes cover is also on the right track. However, practical implementation is only slowly getting underway and other export credit agencies, such as those in Denmark, Switzerland and Austria, continue to offer their exporting companies far more flexibility. Progress is urgently needed in linking development co-operation funds and export credit insurance.

Industry Reports

Given the heterogeneity of the industry and a project business characterised by irregularly awarded large orders, it is difficult to make quantitative forecasts for business development in large-scale plant engineering. The assessment of the industry's prospects is therefore sensibly broken down into individual segments and in the form of trend statements. The following industry reports reflect the assessments of the members of large-scale plant engineering on their respective fields of activity. We also present a concise update of the articles from the previous year in the ‘Update of the industry reports for 2024’ - on the areas of chemical plant engineering, metallurgical plant engineering, rolling mill engineering and paper plant engineering. This will give you a quick and targeted insight into the most important changes in these specific markets.

Events

Previous Status Reports

.jpg/021e0998-9af6-8a9c-3deb-bd3feb891d87)

.png/2bb3a770-d917-e46b-576a-2c3eb5550c5a)

.png/e78b6a9b-8a36-c50e-e2a9-f22ee9a473bc)

.png/014aba66-7ff5-e26f-e137-492eed73c15d)

.jpg/9d7bfa5c-3afe-f408-8910-14c7feb56554)

.jpg/b9f6007e-5f82-c8ed-0d17-56bd76e8beed)