WG Large-scale Plant Engineering - Status Report 2023/24

Innovative and resilient - how large-scale plant engineering remains successful

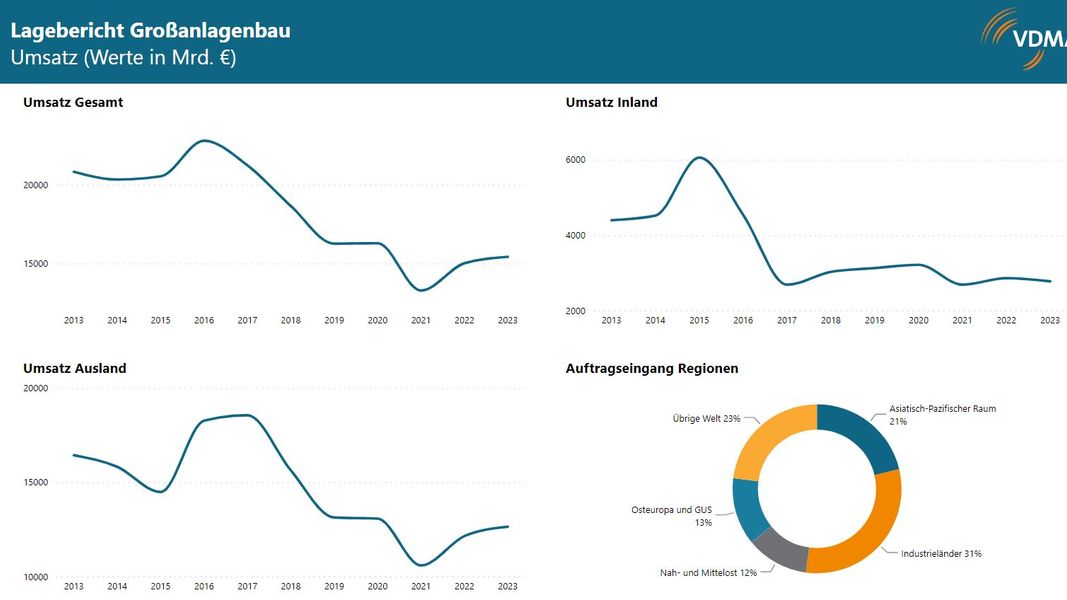

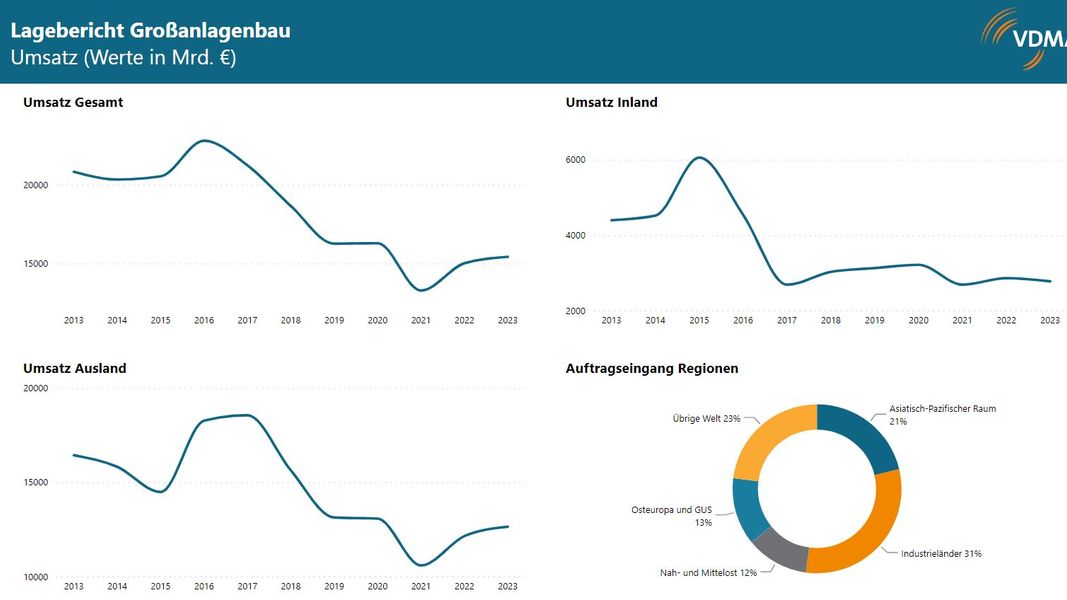

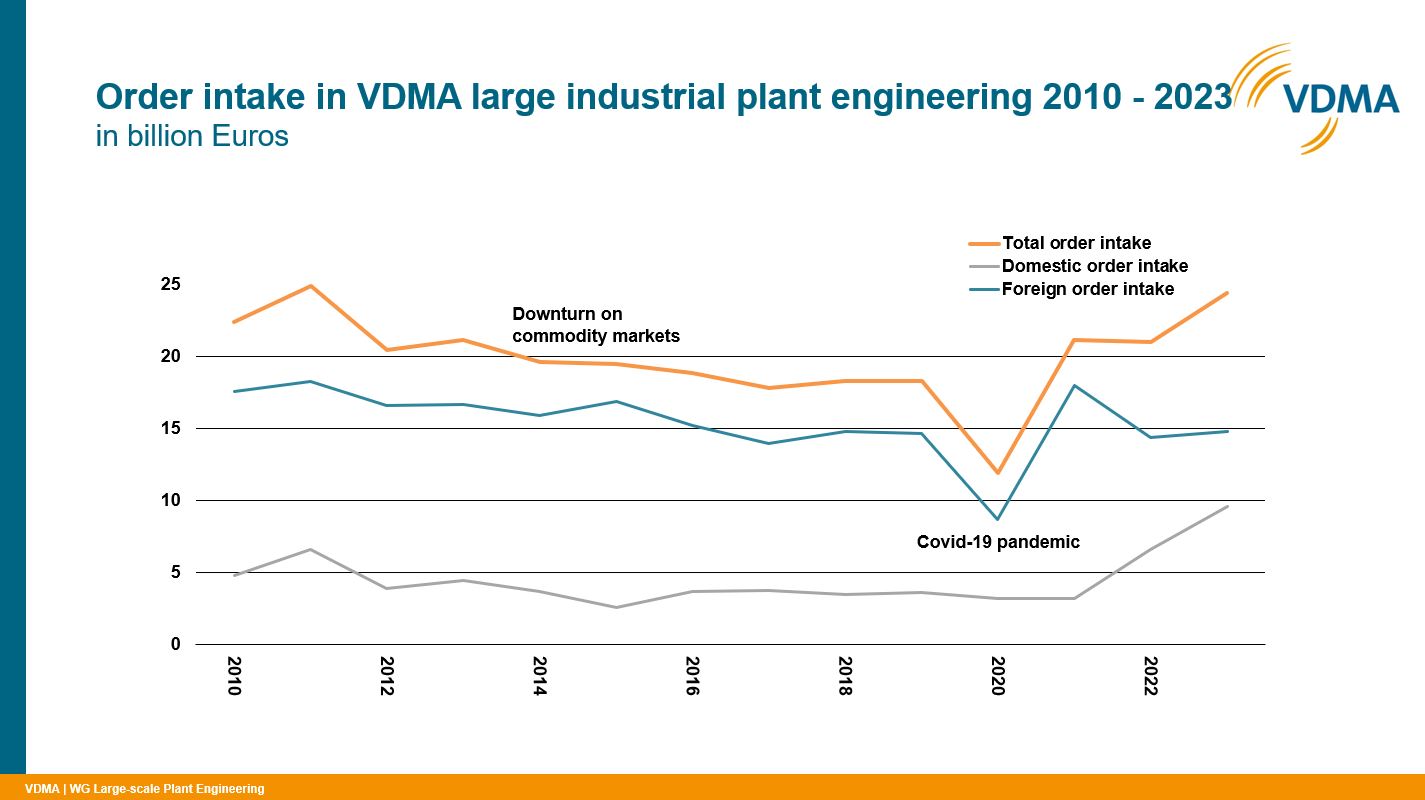

Business development

Market environment and trends in large-scale plant engineering

Political positions

Industry Reports

Exclusively for VDMA members

Register now and read more

Don't have an account?

If your company is already a VDMA member, you can register easily.

Do you not know whether your company is already a member? Take a look at our member list and find out.

Are you interested in becoming a VDMA member?

.jpg/030ef2e6-5d98-f801-024f-d88398e61588)

.jpg/9d7bfa5c-3afe-f408-8910-14c7feb56554)

.jpg/b9f6007e-5f82-c8ed-0d17-56bd76e8beed)